Taxes have increased too much: A flat-tax proposal and sewer refund

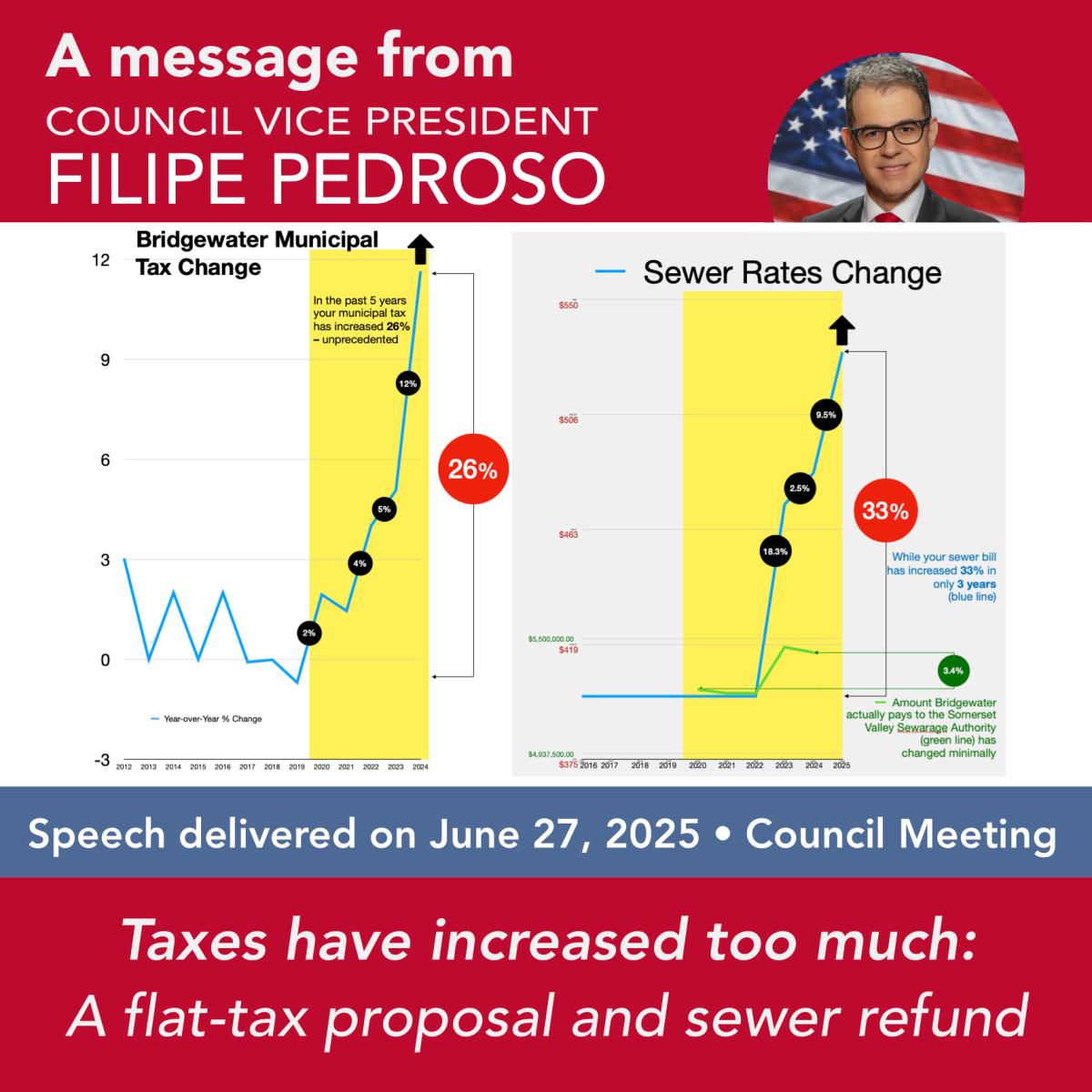

Real estate taxes in Bridgewater have gone up too much. In fact, in the past 4 years, your [municipal] taxes have gone up 22%. It’s time to give relief to the taxpayers who shoulder this burden. See Bridgewater municipal tax graph.

Tonight, I’m proposing a budget amendment that keeps municipal taxes flat — and by flat, I mean truly flat. I don’t mean keeping the tax rate flat — because when property values rise, that still results in a higher tax bill. What I’m proposing is that residents pay the same amount in 2025 as they did in 2024.

Let me be clear: If your home is assessed at the average Bridgewater value of $576,459, you likely paid $1,372 in municipal taxes last year. Under this budget amendment, you’ll still pay exactly the same — $1,372 this year. And I don’t have to go through some smoke and mirror calculation about fooling you about a $6 tax increase. To accomplish that, we need to lower the tax rate from 0.290 to 0.238.

This budget amendment makes thoughtful, targeted reductions — mostly in the “Other Expenses” lines across departments. But it does not touch our police budget, it does not cut funding for senior services, and it protects essential services. I have always supported our police, and I will continue to ensure they have what they need to keep us safe.

This proposal also respects and protects the hardworking men and women who serve this Township. With one exception, no jobs are eliminated. The only proposed staffing reduction is in the Office of Constituent Relations — a department that, frankly, has become top-heavy. Many residents have voiced concerns about this office, and I agree with them. Every other department keeps its staff and leadership. And I thank all of them for their service.

Making budget changes at this stage is not unusual. In 2019, then Councilman Matthew Moench and I, both on the Budget Finance Committee at the time, introduced a modified budget at adoption. We also made substantial cuts. Mayor Hayes warned of “disaster” — but the Township did just fine, and taxpayers benefited.

So tonight, I’m asking this Council to do what’s right. This amendment protects core services, trims excess, and reflects the sound fiscal responsibility our residents expect.

Let me briefly address the sewer budget, which by the way, has gone up 33% in four years. The Township is clearly collecting more than needed — proven by the plan to shift $730,000 from sewer surplus into the municipal budget.

Let’s give some of that back. I propose a $21.63 refund per household this year and a lower sewer rate going forward. It’s fair, it’s responsible, and it’s the right thing to do.